PaydaySOS is a revolutionary online lender connection service specifically designed to help thousands of Americans access emergency funds quickly when unexpected financial situations arise. This innovative platform serves as a bridge between borrowers facing urgent cash needs and a carefully vetted network of reputable lenders who specialize in various types of short-term and emergency loans including payday loans, cash advances, personal loans, and installment loans. Unlike traditional banks that can take days or even weeks to process loan applications with extensive paperwork, credit checks, and in-person visits, PaydaySOS streamlines the entire borrowing process into a simple, secure online experience that takes less than 5 minutes to complete from the comfort of your home using any desktop computer, laptop, mobile phone, or tablet device. The service is specifically designed for people facing emergency expenses such as unexpected medical bills, urgent car repairs, overdue utility payments, or other financial emergencies that simply cannot wait for the next payday.

The platform operates on a sophisticated lender-matching technology that connects your single loan request with multiple lenders simultaneously, maximizing your chances of approval while saving you the time and hassle of applying with numerous lenders individually. Once you complete the simple online form with basic personal and financial information, PaydaySOS's secure system transmits your information using bank-level 256-bit SSL encryption—the same advanced security technology used by major financial institutions—to protect your sensitive data from unauthorized access or identity theft. The lender network includes established, reputable financial service providers who have been carefully screened to ensure they follow fair lending practices, transparent terms, and ethical collection procedures. This means you can trust that any loan offer you receive through PaydaySOS comes from a legitimate lender committed to responsible lending and customer satisfaction.

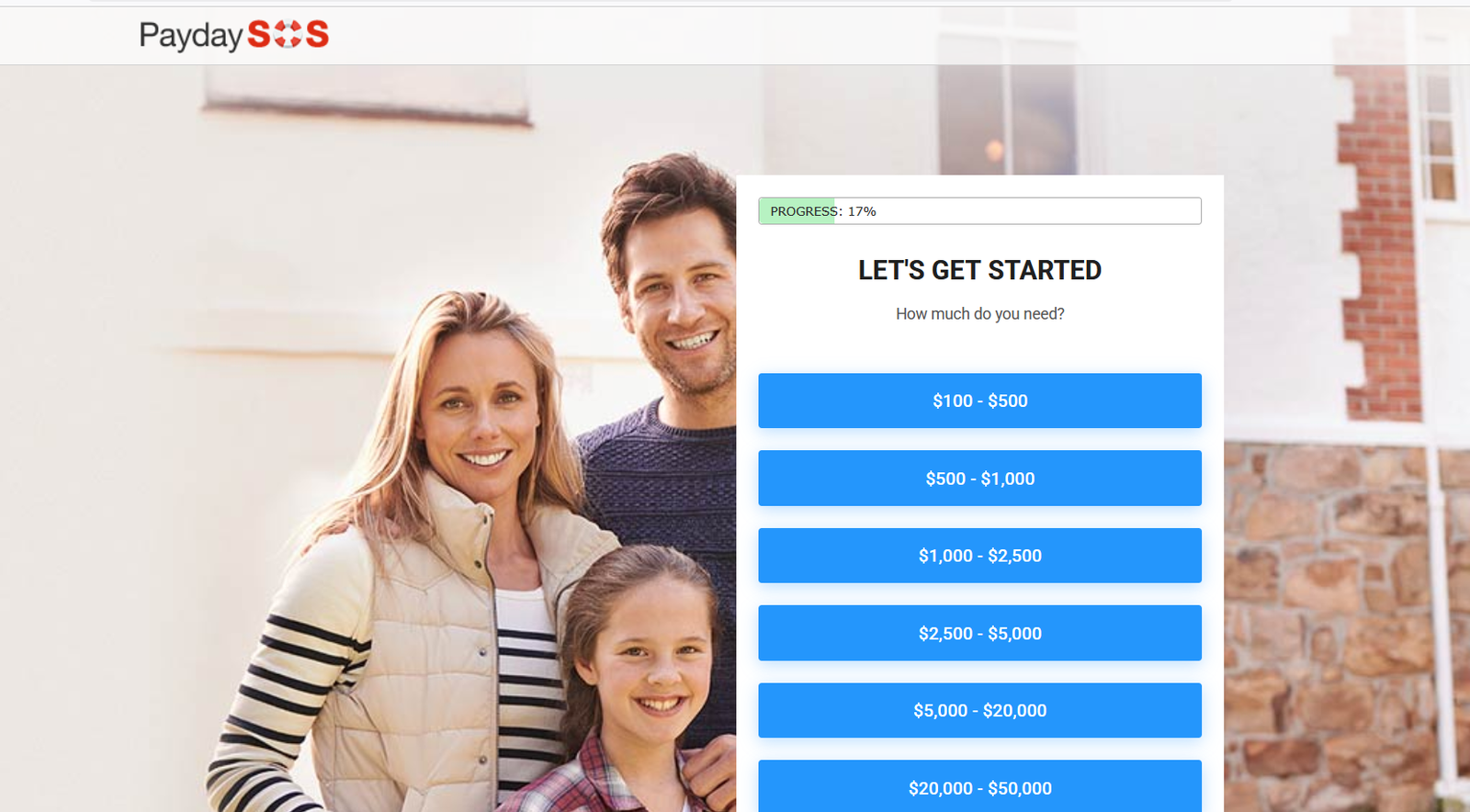

What sets PaydaySOS apart from other online lending platforms and traditional loan sources is its commitment to accessibility, speed, convenience, and security for borrowers who may not qualify for conventional bank loans due to credit challenges, limited banking history, or urgent timing needs. The service recognizes that financial emergencies don't follow convenient schedules and that many hardworking Americans live paycheck to paycheck, making unexpected expenses potentially devastating without access to emergency funds. Whether you need $500 to cover an urgent car repair so you can get to work, $2,000 for an emergency medical procedure, or up to $50,000 for a major unexpected expense, PaydaySOS provides a pathway to potential funding without the embarrassment of waiting in physical store lines, the frustration of multiple loan rejections, or the anxiety of wondering how you'll cover critical expenses. With thousands of satisfied customers who have successfully obtained emergency loans through the platform, PaydaySOS has established itself as a trusted resource for Americans seeking fast, convenient access to emergency cash when life's unexpected challenges arise.